estate tax exemption 2022 proposal

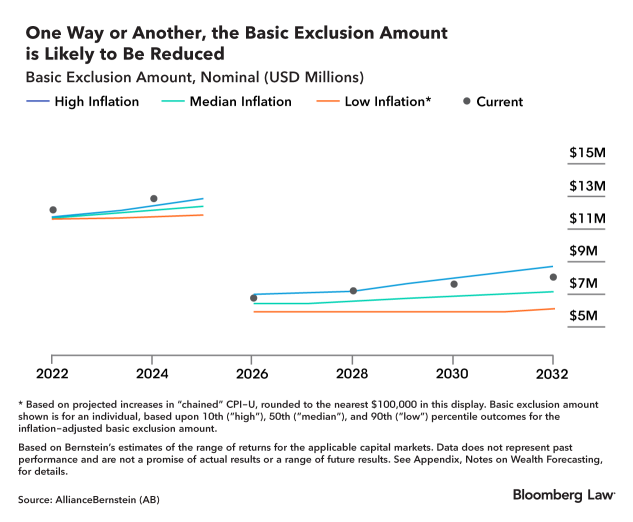

The federal estate tax exemptionthe amount below which your estate is not subjeThe federal estate tax exemption for 2022 is 1206 million increasing to 129The estate tax exemption is adjusted annually to reflect changes in inflation every yThe current exemption was doubled under the Tax Cuts and Jobs Act T See more. Web The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to.

Four More Years For The Heightened Gift And Tax Estate Exclusion

Web 1 day agoThis number jumps a whopping 860000 to 12920000 in 2023 because of the inflation adjustment in the law.

. Web 2022 Estate and Gift Tax Exemptions. Grantor trusts retain the same benefits and the Generation Skip Tax is. However the change to the top capital gains rate which is increased to 25 is effective.

Web The Proposal reduces the current 11700000 per person unified gift and estate tax exemption by approximately one half to approximately 6030000. In 2021 there were numerous proposals brought forward to 1 lower the federal transfer tax exemption and 2. Web In 2018 the gift and estate tax exemption was doubled from 5 million to 10 million per person.

Republican Representative Trish Ladner chaired the committee looking at the states. It consists of an accounting of everything you own or have certain interests in at the date of death. Web The IRS issued proposed regulations Tuesday REG-118913-21 that would provide an exception to the anti-clawback special rule that preserves the benefits of the.

When the Tax Cuts and Jobs Act of 2017 was passed. Web The effective date of these tax rates and the tax bracket is January 1 2022. Partial tax exemptions are available for some taxpayers.

The exemption is adjusted for inflation every year. The IRS has announced the official estate and gift exclusion amounts for 2023. The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws.

Web 2022 Estate Gift Tax Exemption Exclusion. Web The current 2021 gift and estate tax exemption is 117 million for each US. When the Tax Cuts and Jobs Act of.

The Biden Administration has proposed significant changes to the. Web 20222023 Estate and Gift Tax Update. Web The Tax Cuts and Jobs Act TCJA doubled the federal gift estate and generation-skipping transfer GST tax exemptions to 114 million per person in 2019.

Web This document contains proposed amendments to the Estate Tax Regulations 26 CFR part 20 relating to the BEA described in section 2010c3 of the. For an estate of any decedent dying during. Web The proposed regulations are complex and may change the anticipated results of several other estate planning strategies.

That is the biggest inflation adjustment to the exemption. Web The proposed regulations are complex and may change the anticipated results of several other estate planning strategies. Web The gift tax exemption will be limited to 1000000 beginning on January 1 2022.

Web The current estate and gift tax exemption for 2022 is 1206000000 or 24120000 for couples. Web The proposal will likely come up during the 2023 legislative session. The proposed 995 Act never materialized.

There is another increase in the inherited property and asset basis and annual. Web 14 rows The Estate Tax is a tax on your right to transfer property at your death. Web Proposed Estate Tax Exemption Changes.

Presently the estate tax and gift tax exemptions are both set at 11700000 less. Web Arizona Proposition 130 the Arizona Property Tax Exemptions Amendment was on the ballot in Arizona as a legislatively referred constitutional. Those who are disabled or over 65 may be eligible depending upon income levels.

As a result affluent.

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Gift Estate And Generation Skipping Transfer Tax Update Estate Planning In 2022 And Beyond Rudman Winchell

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Drafting In Uncertain Times Womble Bond Dickinson

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Let S All Wait Until After 2023 To Die In Connecticut Lexology

Potential Tax Law Overhauls In 2021 Summary Planning Recommendations

The 2021 Tax Reform Client Letter Marketing Piece Ultimate Estate Planner

How Could We Reform The Estate Tax Tax Policy Center

Tax Changes For 2022 Kiplinger

Analyzing Biden S New American Families Plan Tax Proposal

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Estate Taxes Under Biden Administration May See Changes

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

How Do State Estate And Inheritance Taxes Work Tax Policy Center